Starting a franchise in Toronto demands careful attention to legal requirements. Franchising provides a proven business model, but it involves complex rules. Ontario’s strict regulations protect franchisees and hold franchisors accountable. A key requirement is the Franchise Disclosure Document, often called the FDD.

This document ensures transparency and helps franchisees make informed choices. In Toronto’s growing franchise market, professional legal guidance prevents costly mistakes and builds a strong foundation for success.

Key Takeaways

- Learn the critical role of the Franchise Disclosure Document in ensuring transparency for franchisees.

- Understand key components, like fees and financial statements, required in an FDD.

- Explore the risks of errors in FDD preparation and their legal consequences.

- Discover how professional legal support streamlines compliance with Ontario’s franchise laws.

- Gain insights into reviewing FDDs and franchise agreements for long-term success.

Importance of Legal Compliance in Franchising

Ontario’s Arthur Wishart Act (Franchise Disclosure), 2000 governs franchising. It requires franchisors to provide a clear, detailed FDD to prospective franchisees. The FDD plays a vital role in franchising. It discloses essential details about the franchise

system. Its purpose is to inform franchisees about costs, risks, and obligations before they commit. This transparency builds trust and helps franchisees evaluate the opportunity. Without it, franchisors risk legal challenges, and franchisees may face unexpected hurdles.

The Arthur Wishart Act mandates delivering the FDD at least 14 days before any agreement or payment. This cooling-off period in Ontario allows franchisees to review the document carefully. They can consult advisors and assess the franchise’s potential. Non-compliance, such as late delivery or incomplete disclosures, carries serious consequences. Franchisees may rescind the agreement within 60 days of receiving the FDD. If no FDD is provided, this right extends to two years. Rescission can lead to refunds and compensation for losses.

Toronto’s franchise market is vibrant, with sectors like food service and retail growing steadily. Compliance with Ontario franchise law compliance is essential to avoid disputes. A Toronto franchise law firm ensures your FDD meets legal standards. This protects your business and strengthens your reputation. For example, a Toronto-based coffee franchise avoided penalties by working with legal experts to perfect their FDD. Professional guidance makes compliance straightforward and effective.

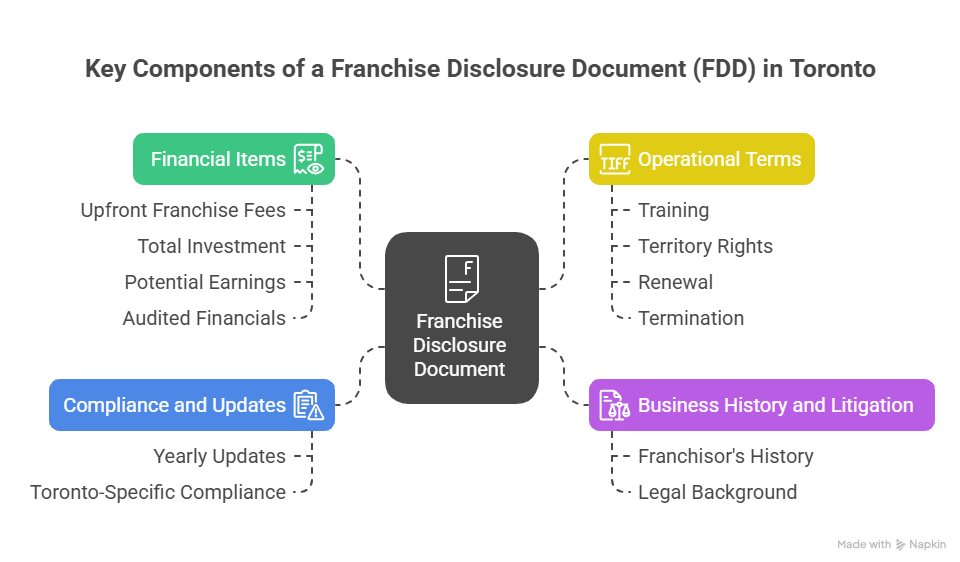

Key Components of a Franchise Disclosure Document

An FDD must include specific details to meet Ontario’s legal requirements. These components provide a clear picture of the franchise opportunity. Item 5 details the initial franchise fees, such as upfront costs to join the system. Item 7 estimates the total initial investment, covering equipment, real estate, and training costs. Item 19, when included, shares financial performance data, like potential earnings. These must have a reasonable basis to avoid misleading franchisees. Item 21 requires audited financial statements. These confirm the franchisor’s financial stability and build trust.

Other key items include the franchisor’s business history and any litigation. The FDD also outlines operational rules, such as training and territorial rights. Renewal and termination terms clarify long-term commitments. The document remains valid until updated, typically annually or after major changes, like new lawsuits. This ensures ongoing accuracy. A FDD preparation lawyer Toronto can craft a document that meets all these requirements, tailored to Toronto’s unique franchise environment.

For instance, a retail franchise in Scarborough worked with Cloudhaus Law to include precise fee disclosures. This clarity attracted confident investors. The Franchise disclosure document Toronto must reflect local regulations. With Toronto’s franchise sector projected to grow by 5% annually, accuracy in these components is critical for success.

Risks of Inaccurate Disclosure

Mistakes in an FDD can lead to significant problems. The risks of FDD errors or omissions include legal disputes and financial losses. If fees or earnings projections are misstated, franchisees may claim misrepresentation. Under the Arthur Wishart Act, they can seek damages or rescind the agreement. Omitting required details, like litigation history, weakens the document’s credibility. This can trigger penalties and harm the franchisor’s reputation.

In Toronto’s competitive market, errors can deter potential franchisees. For example, a fitness franchise faced a lawsuit after failing to disclose a past dispute. This damaged their expansion plans. A Toronto franchise disclosure lawyer prevents such issues by ensuring accuracy. Cloudhaus Law, with experience in over 70 GTA franchise locations, reviews every detail to protect your business. This diligence avoids costly mistakes and builds trust with investors.

Benefits of Professional Legal Support

Hiring a lawyer with Toronto franchise lawyer expertise simplifies FDD preparation. They review critical elements, like fees and financial statements, for compliance. This process ensures the FDD lawyer benefits Toronto by reducing risks. For franchisors expanding from the U.S., dual-qualified lawyers offer unique insights. They align the FDD with Canadian laws while addressing cross-border needs. Cloudhaus Law has helped foreign franchisors enter Canada seamlessly.

The cost of preparing an FDD in Toronto ranges from $10,000 to $30,000. Costs depend on the franchise’s complexity and the lawyer’s experience. Preparation typically takes several weeks. This timeline varies based on financial data availability. While the investment is notable, it prevents larger losses from legal errors. A Toronto FDD preparation services provider like Cloudhaus Law ensures efficiency. Their work on 70+ GTA franchises proves their ability to deliver results.

As a franchisor, you gain tailored advice for your business model. For example, a food franchise in Mississauga benefited from Cloudhaus Law’s guidance on territorial rights. This clarity strengthened their FDD and attracted franchisees. To learn more about franchise compliance, download our franchise law guide today. It offers practical tips for success in Toronto’s dynamic market.

Franchise Agreements vs. FDDs

The FDD and franchise agreement serve distinct roles. The FDD discloses information to inform franchisees. The franchise agreement is the binding contract. In Ontario, a document becomes legally binding when both parties sign it with clear intent. The agreement details royalties, operational standards, and termination rules. The franchise agreement lawyer Toronto ensures both documents align. Discrepancies, like differing fees, can lead to disputes.

Reviewing both with a best franchise lawyer Toronto prevents issues. Cloudhaus Law’s expertise in franchise agreement review ensures clarity. For instance, a Toronto retail franchise avoided conflicts by aligning their FDD and agreement. This protected their franchisee protections and built trust. Professional review is essential for compliance and confidence.

Advantages and Challenges of FDD Preparation

The pros and cons of FDD preparation highlight its value and complexity. A strong FDD builds trust by providing clear information. It supports franchise expansion by attracting informed investors. Compliance with franchise regulations enhances your brand’s credibility. In Toronto, where franchises thrive, this is a key advantage. However, preparation is time-intensive. Gathering audited financial statements and detailing operations can be challenging.

A franchise lawyer consultation Toronto simplifies this process. Cloudhaus Law’s experience ensures every detail is addressed. For example, a client expanding a gym franchise praised our thorough approach. Their FDD met all legal standards, boosting investor confidence. Professional support turns challenges into opportunities for growth.

Reviewing an FDD Effectively

Evaluating an FDD requires focus on key details. Check the clarity of fees, including initial and ongoing costs. Review the franchisor’s litigation history and financial health. Territorial rights and renewal terms define your operational scope. A FDD compliance lawyer Ontario guides this process. They ensure the FDD aligns with your goals and meets legal standards.

Cloudhaus Law’s client-focused approach shines here. A foreign franchisor expanding to Toronto said, “Irbaz’s expertise in franchise due diligence was invaluable. His attention to detail gave us confidence.” This support helps both franchisors and franchisees make informed choices in Toronto’s competitive market.

Frequently Asked Questions About FDDs in Ontario

To address common concerns about franchise disclosure in Ontario, we’ve compiled answers to key questions. These clarify the FDD’s role and requirements for franchisors and franchisees.

Why is there a need to conduct an FDD in Ontario?

Ontario’s Arthur Wishart Act mandates an FDD to ensure transparency. It provides franchisees with critical details about costs, risks, and obligations. This protects them from uninformed investments and helps franchisors build trust. A properly prepared FDD, crafted with Ontario FDD legal advice, prevents legal issues and supports successful franchise relationships in Toronto’s thriving market.

What must be included in a Franchise Disclosure Document (FDD)?

An FDD must include the franchisor’s business history, financial statements, and litigation details. It covers fees, estimated investments, and operational rules. Items like training, territorial rights, and renewal terms are also required. A Toronto FDD preparation services provider ensures these elements meet franchise regulations, giving franchisees a clear view of the opportunity.

Are FDDs legally binding in Ontario?

FDDs are not binding contracts. They provide disclosures to inform franchisees. The franchise agreement, signed by both parties, is the binding document. However, inaccurate FDDs can lead to legal issues, like rescission or damages. A Toronto franchise disclosure lawyer ensures accuracy to avoid disputes and maintain compliance.

How do I request a disclosure document in Ontario?

To request an FDD, contact the franchisor in writing, expressing interest in the franchise. The Arthur Wishart Act requires delivery at least 14 days before signing or paying. A franchise lawyer consultation Toronto can help draft the request and review the FDD for accuracy, ensuring you’re well-informed.

What is the difference between a franchise agreement and the FDD?

The FDD discloses key information to inform franchisees, while the franchise agreement is the binding contract outlining operational and financial terms. Misalignments can cause disputes. A franchise agreement lawyer Toronto reviews both to ensure clarity and compliance, protecting both parties in the franchise relationship.

What happens if the franchisor fails to provide proper disclosure?

If a franchisor fails to provide a proper FDD, franchisees can rescind the agreement within 60 days of delivery or two years if no FDD is provided. They may recover fees and losses. Penalties and lawsuits can also arise. A FDD compliance lawyer in Ontario prevents these risks through accurate preparation.

Sustaining Compliance for Long-Term Success

FDDs require updates to stay valid. Franchisors must revise the document annually or after major changes, like new litigation. These FDD amendments ensure ongoing compliance. In Toronto, franchise registration is critical to avoid legal penalties. A FDD compliance lawyer in Ontario manages these updates efficiently. Cloudhaus Law’s work with 70+ GTA franchises demonstrates this expertise.

For franchisors, you need a partner who understands Toronto’s market. Our dual-qualified expertise in Canada and U.S. laws supports cross-border expansion. This ensures your FDD remains accurate and effective, fostering long-term success.