Franchising fuels Ontario’s economy, contributing significantly to Canada’s GDP. Whether launching a Tim Hortons in Toronto or scaling a healthcare franchise across the GTA, understanding what is franchise law in Ontario is vital for success and legal protection.

The Arthur Wishart Act (Franchise Disclosure), 2000, governs all franchise relationships, ensuring transparency and fairness. It regulates diverse sectors, from global giants like Subway to local tech startups. Compliance prevents costly disputes, fostering sustainable partnerships.

This guide details the Act’s requirements, franchisee rights, franchisor obligations, 2020 amendments, and dispute resolution options, offering a franchising roadmap for franchisees. For tailored advice, consult a franchise lawyer, as this guide is informational only.

Key Takeaways

- Arthur Wishart Act compliance

- Franchisee legal protections

- Franchisor disclosure duties

- Impact of recent legislative changes

- Effective dispute resolution strategies

Why Franchise Law Matters in Ontario

Franchising generates over $120 billion in Canada’s GDP, with Ontario leading the sector. The Arthur Wishart Act, 2000, shapes this dynamic industry by mandating transparency and protecting both franchisors and franchisees.

Whether opening a McDonald’s or a local service franchise, following the correct legal steps for a Canada franchise is crucial to avoid legal issues and ensure growth. The Act enforces clear disclosure, fair dealing, and consumer protection, building trust in franchise relationships. Non-compliance risks disputes, financial losses, or business failure.

The Purpose Behind Ontario Franchise Law

The Arthur Wishart Act, 2000, promotes transparency, fairness, and consumer protection in Ontario’s franchise sector. Named after Arthur Wishart, who championed franchisee rights, it addresses power imbalances between franchisors and franchisees. Developed through stakeholder input, the Act ensures:

- Information transparency

- Investment protection

- Market stability

- Balanced relationships

By requiring detailed disclosure and fair dealing, it safeguards franchisees’ significant investments while fostering a reliable franchise market. To ensure you are protected from the start, follow a due diligence checklist for buying a franchise in Canada.

Understanding the Arthur Wishart Act: Legislative Foundation

Legislative Intent and Historical Context

The Arthur Wishart Act emerged in 2000 to address the growing franchise sector’s need for consumer protection. Before its enactment, franchisees often faced unfair practices due to minimal legal oversight, leaving them vulnerable to exploitation by more powerful franchisors.

Developed through consultations with industry experts, legal professionals, and government officials, the Act reflects broader consumer protection trends from the late 1990s. It adapts contract law to the unique dynamics of franchise relationships, ensuring fairness and transparency. The Act’s core objectives include:

- Correcting Information Asymmetry: Franchisors must disclose critical details, ensuring franchise document transparency regarding financial performance and operational challenges.

- Protecting Investments: Franchisees often invest life savings, and the Act provides legal recourse for non-compliance, safeguarding financial commitments.

- Ensuring Market Integrity: Clear standards promote confidence in franchising, supporting economic growth and stability across Ontario’s diverse franchise landscape.

- Regulating Relationships: Ongoing fair dealing and good faith obligations maintain balanced partnerships throughout the franchise term.

The Act’s development considered real-world franchise disputes, ensuring practical solutions. Its influence extends beyond Ontario, inspiring similar laws in other provinces and reinforcing Canada’s reputation for balanced franchise regulation. By addressing historical gaps, the Act empowers franchisees while allowing franchisors flexibility to innovate and grow.

Scope and Application

The Arthur Wishart Act applies to any franchise operating wholly or partly in Ontario, regardless of the franchisor’s location. This broad scope ensures consistent regulation across different franchise structures, from local startups to international chains. Key applications include:

- Physical Locations: Franchises with premises in Ontario, such as restaurants or retail stores, fall under the Act’s jurisdiction, ensuring uniform compliance.

- Online Operations: Digital franchises serving Ontario customers may be subject to the Act, depending on operational structures and customer interactions.

- Multi-Provincial Franchises: Ontario law governs the province’s operations, even if other provinces apply different regulations, ensuring clarity for multi-jurisdictional systems.

- International Franchisors: Foreign brands following a Canadian franchise US expansion legal guide must adapt to the Act’s standards.

This comprehensive scope protects franchisees while allowing franchisors to operate across borders, provided they meet Ontario’s rigorous standards. The Act’s territorial clarity prevents loopholes, ensuring all franchise relationships in Ontario adhere to the same legal framework, fostering a stable and trustworthy market environment.

Key Legal Definitions

Understanding the Act’s definitions is essential for compliance and navigation. Key terms include:

- Franchise: A business where the franchisee operates under the franchisor’s trademark, with significant franchisor control and payment for rights.

- Material Facts: Information impacting the franchise’s value or purchase decision, including financial data, operational challenges, and market conditions.

- Franchisor: The entity granting franchise rights, including corporations, partnerships, or individuals, regardless of structure.

- Franchisee: The individual or entity operating the franchise, encompassing new or existing businesses adopting franchise models.

- Prospective Franchisee: Anyone expressing interest in a franchise, protected from initial discussions to ensure early transparency.

- Associate: Entities linked to franchisors through ownership or control, preventing evasion of disclosure obligations.

These definitions clarify roles, responsibilities, and protections, ensuring all parties understand their obligations under the Act. They provide a foundation for compliance and dispute resolution, making the legal framework accessible and enforceable.

The Cornerstone: Franchise Disclosure Document Requirements

Document Purpose and Legal Foundation

The Franchise Disclosure Document (FDD) is the heart of Ontario’s franchise law, ensuring prospective franchisees receive all material facts to make informed investment decisions. The FDD serves critical functions:

- Informing Franchisees: Provides comprehensive details about the franchise opportunity, enabling thorough evaluation and risk assessment.

- Establishing Standards: Sets legal benchmarks for franchisor transparency, ensuring accountability and consistency.

- Supporting Relationships: Creates a foundation for trust and clarity, fostering sustainable franchise partnerships.

- Protecting Investments: Ensures franchisees have the information needed to safeguard significant financial commitments.

Adapted from U.S. models, Ontario’s FDD requirements are among the most detailed globally, reflecting a commitment to franchisee protection. Franchisors must deliver the FDD at least 14 days before any agreement or payment, allowing ample review time. Non-compliance risks severe penalties, including rescission rights, making the FDD a cornerstone of legal and operational compliance.

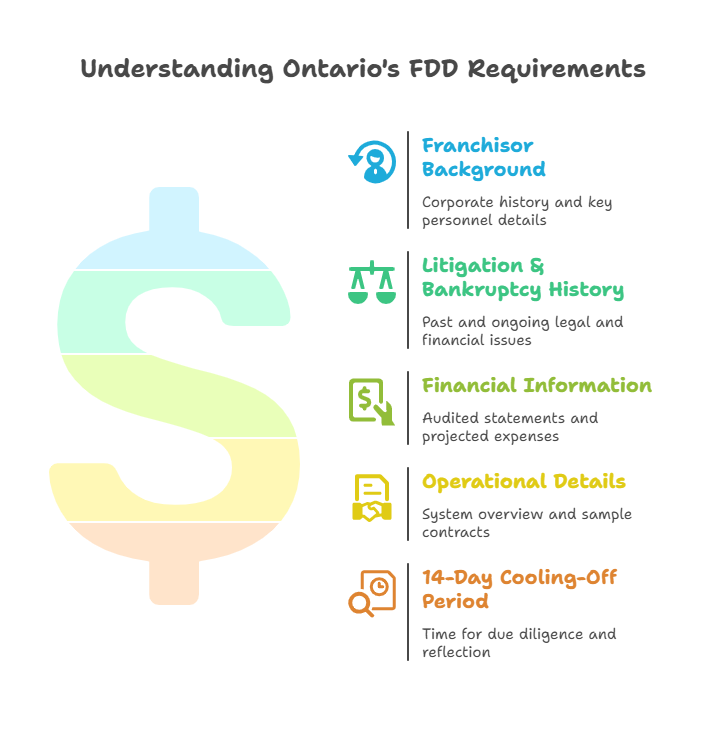

Essential Content Requirements

The FDD must include verifiable, comprehensive information to support franchisee decision-making. Key components include:

- Franchisor Background:

- Corporate history: Formation, name changes, and restructuring details to assess stability.

- Business experience: Key personnel’s franchising and industry expertise, ensuring credibility.

- Related companies: Details of subsidiaries or affiliates involved in operations.

- Other ventures: Principals’ involvement in related businesses, highlighting relevant experience.

- Litigation and Bankruptcy History:

- Ongoing proceedings: Current legal actions affecting franchise operations or stability.

- Historical litigation: Civil, criminal, or regulatory actions from the past six years.

- Bankruptcy filings: Insolvency proceedings involving the franchisor or affiliates.

- Regulatory actions: Investigations or sanctions related to franchising or consumer protection.

- Financial Information:

- Audited financial statements: Reflecting the franchisor’s stability and performance.

- Fee structures: Initial fees, royalties, marketing contributions, and other costs.

- Projected expenses: Detailed cost estimates for franchisees, ensuring transparency.

- Operational Details:

- Franchise system overview: Structure, support, and operational requirements.

- Franchisee lists: Contact details for current and former franchisees for due diligence.

- Contract copies: All agreements to clarify legal obligations.

These requirements ensure franchisees receive a complete picture of the opportunity, risks, and obligations, enabling informed decisions and reducing the likelihood of disputes.

The Critical 14-Day Cooling-Off Period

The Act mandates a 14-day cooling-off period before signing agreements or making payments, allowing franchisees time to:

- Conduct Due Diligence: Review FDD contents, verify claims, and assess risks.

- Consult Professionals: Engage a franchise lawyer to evaluate the opportunity.

- Interview Franchisees: Contact current and former franchisees for firsthand insights.

- Reflect on Decisions: Avoid impulsive commitments, ensuring informed choices.

Grounded in behavioral economics, this period reduces financial risks by promoting thorough evaluation. Franchisees must use this time strategically to verify information, assess market conditions, and plan their investment, ensuring alignment with their business goals and financial capacity.

Key Franchisee Rights: Ontario Protections

The Right of Rescission: Your Legal Safety Net

The Act provides a robust rescission under the Arthur Wishart Act, allowing franchisees to cancel agreements under specific conditions:

- 60-Day Rescission:

- Triggered by incomplete or misleading FDDs.

- Starts when proper disclosure is received.

- Includes full refund of fees, expense recovery, and release from obligations.

- Requires written notice and evidence of disclosure deficiencies.

- Two-Year Rescission:

- Applies when no FDD is provided.

- Allows cancellation within two years of signing.

- Offers identical remedies to 60-day rescission.

- Places the burden on franchisors to prove disclosure compliance.

These rights protect franchisees from financial losses due to non-compliance, offering a powerful safety net. Franchisees must act promptly and provide clear documentation to exercise these rights effectively, ensuring recovery of investments and related costs.

Right to Fair Dealing and Good Faith

Both parties must act with good faith and fair dealing, as defined by Ontario courts:

- Honest Communication: Providing accurate, non-misleading information.

- Reasonable Standards: Adhering to industry norms and practices.

- Mutual Respect: Supporting each party’s legitimate business interests.

- Consistent Application: Applying policies uniformly across the franchise system.

- Transparency: Communicating openly about changes or challenges.

This obligation fosters trust, reduces conflicts, and supports long-term franchise success. Courts enforce these standards, ensuring both parties act in ways that promote mutual benefit and system integrity.

Right to Associate with Other Franchisees

Franchisees can freely form associations and communicate, including:

- Creating Associations: Formal or informal groups for support and advocacy.

- Joining Organizations: Participating in advisory councils or industry groups.

- Free Communication: Sharing experiences without franchisor interference.

- Collective Bargaining: Negotiating system policies or fees collectively.

This right strengthens franchisee collaboration, balances power dynamics, and promotes collective advocacy, ensuring franchisees can address system-wide issues effectively.

Essential Franchisor Obligations and Compliance

Disclosure Accuracy and Completeness

Franchisors are strictly liable for accuracy. They must know how to prepare franchise disclosure documents that include current information and factual accuracy. requiring:

- Factual Accuracy:

- Verifiable claims supported by documentation.

- Current information reflecting present conditions.

- Objective, independently verifiable data.

- Contextual presentation for clarity.

- Ongoing Obligations:

- Annual FDD updates with current financials and franchisee lists.

- Prompt disclosure of material changes via statements.

- Systems to verify ongoing accuracy.

- Professional review by legal and accounting experts.

These standards ensure franchisees receive reliable, up-to-date information, reducing risks and fostering trust throughout the relationship.

Prohibition Against Misrepresentation

The Act prohibits active misrepresentations and material omissions:

- Active Misrepresentation:

- False statements about performance or support.

- Misleading information distorting the opportunity.

- Unsubstantiated claims lacking evidence.

- Oral contradictions to written disclosures.

- Material Omissions:

- Incomplete financial or litigation disclosures.

- Hidden fees or expenses.

- Undisclosed competitive or operational challenges.

- Systemic issues affecting franchise success.

These prohibitions protect franchisees from deceptive practices, ensuring informed decision-making and reducing dispute risks.

Franchise Agreements in Ontario: Essential Terms and Considerations

Critical Agreement Components

Franchise agreements must comply with the Act and contract law, including:

- Fee Structures:

- Initial fees: $25,000-$75,000, based on brand and support.

- Royalties: 4-8% of revenue or flat fees.

- Marketing contributions: 1-3% of revenue for system-wide campaigns.

- Technology/training fees: For systems and support services.

- Territory Rights:

- Exclusive territories: Preventing competition from other franchisees.

- Protected radius: Distance-based protection around locations.

- Population-based territories: Aligned with market demographics.

- Non-exclusive arrangements: With competition risks to evaluate.

These terms clarify financial and operational boundaries, ensuring both parties understand their obligations and rights.

Strategic Agreement Negotiation

Effective negotiation enhances terms:

- Market Analysis: Assess local conditions for fair terms.

- Performance Milestones: Include standards for benefits like reduced fees.

- Flexibility Provisions: Allow adaptation to market changes.

- Exit Strategies: Plan for termination or sale options.

These strategies balance interests, promoting sustainable and mutually beneficial agreements.

2020 Arthur Wishart Act Amendments: What Changed

Refundable Deposit Provisions

The 2020 amendments clarified if a franchise fee refund is possible after signing, ensuring specific deposit limits.

- Deposit Limits: Up to 20% of initial fees, capped at $100,000.

- Refundability: Full refunds without penalties.

- Agreement Limits: No binding obligations from deposits.

- Timing Compliance: Aligns with disclosure requirements.

These changes provide flexibility while protecting franchisees during evaluation.

Confidentiality and Location Agreements

The amendments allow preliminary agreements to support a thorough franchise buying guide process for potential owners.

- Confidentiality: Protecting proprietary information.

- Location Reservation: Securing sites without full disclosure.

- Information Protection: Restricting use of trade secrets.

- Evaluation Facilitation: Supporting due diligence processes.

These provisions streamline early discussions, balancing transparency and practicality.

Financial Statement Flexibility

The amendments support international franchisors by:

- Accepting U.S. Standards: AICPA-compliant statements.

- International Standards: IAASB guidelines recognized.

- Regulatory Alignment: PCAOB standards for public companies.

- Cost Reduction: Eliminating Canadian standard conversions.

These changes reduce compliance costs, encouraging global expansion into Ontario.

Franchise Dispute Resolution in Ontario

Common Dispute Categories

Disputes often involve:

- Disclosure Issues:

- Incomplete or misleading FDDs.

- Timing violations or improper payments.

- Material change disclosure failures.

- Operational Disputes:

- Territory or competition conflicts.

- Insufficient support services.

- Fee or financial disagreements.

- Policy or standard changes.

These categories guide resolution strategies, ensuring targeted solutions.

Alternative Dispute Resolution Methods

Mediation offers:

- Collaborative Solutions: Mutually acceptable outcomes.

- Relationship Preservation: Confidential, non-adversarial process.

- Cost Effectiveness: Lower costs than litigation.

- Creative Resolutions: Innovative solutions beyond legal remedies.

Arbitration and litigation provide additional pathways for complex disputes, with courts offering damages or rescission.

Financial and Tax Considerations for Ontario Franchises

Franchise Fee Tax Treatment

Tax implications include:

- Initial Fees:

- Capital investments, amortized over agreement terms.

- Provincial variations affect treatment.

- Professional consultation advised.

- Ongoing Fees:

- Deductible as business expenses.

- Timing depends on accounting methods.

- Proper documentation required.

These considerations optimize tax planning and compliance.

GST/HST Compliance Framework

Franchisees must:

- Recover Input Tax Credits: For fees and expenses.

- Collect Output Taxes: On goods and services.

- Register for GST/HST: If exceeding revenue thresholds.

- Maintain Records: For compliance and audits.

These obligations ensure tax compliance and financial efficiency.

How Ontario Compares with Other Provinces

Canadian Franchise Regulation Landscape

Provincial laws include:

- Alberta: Similar disclosure, unique mediation provisions.

- British Columbia: Close to Ontario’s model, with timing variations.

- Manitoba: Specific mediation and dispute resolution rules.

- New Brunswick: Ontario-based framework with local adaptations.

- Prince Edward Island: Modern best practices incorporated.

Ontario’s leadership influences national standards, setting a high bar for transparency.

Ontario’s Regulatory Leadership

Ontario excels in:

- Disclosure Standards: Detailed FDD requirements.

- Relationship Regulation: Balanced ongoing obligations.

- Practical Enforcement: Effective remedies and flexibility.

- Regular Updates: Adapting to industry needs.

These strengths make Ontario a model for franchise regulation, fostering trust and growth.

Practical Compliance Guide for Franchisors

FDD Development and Maintenance

Franchisors must:

- Prepare Initial FDDs:

- Gather comprehensive data on financials, operations, and performance.

- Engage experienced lawyers for compliance.

- Verify accuracy of all claims.

- Conduct thorough compliance reviews.

- Maintain FDDs:

- Update annually with current data.

- Disclose material changes promptly.

- Maintain detailed documentation.

- Consult professionals regularly.

These steps ensure ongoing compliance and reduce legal risks.

Practical Guidance for Franchisees

Pre-Investment Due Diligence

Franchisees should:

- Review FDDs:

- Analyze financials, fees, and litigation history.

- Verify franchisee lists and contact details.

- Study territory and contract terms.

- Investigate:

- Interview current and former franchisees.

- Visit operational locations for insights.

- Verify franchisor claims independently.

- Consult Professionals: Engage lawyers and accountants for expert analysis.

These steps protect investments and inform strategic decisions.

Toronto-Specific Considerations and Local Market Insights

Greater Toronto Area Franchise Environment

The GTA offers:

- Economic Diversity: Supports varied franchise concepts across sectors.

- Population Growth: Expands customer bases through immigration.

- High Incomes: Enables premium franchise offerings.

- Cultural Diversity: Creates opportunities for specialized franchises.

These factors drive franchise success and market potential.

Infrastructure and Development Trends

Key trends include:

- Transit Expansion: Opens new commercial opportunities.

- Commercial Real Estate: Requires strategic location analysis.

- Suburban Growth: Expands franchise opportunities.

- Urban Densification: Supports compact, service-based concepts.

These trends shape location and operational strategies.

Municipal Regulatory Considerations

Franchisees must address:

- Business Licensing: Required for all operations.

- Zoning Compliance: Affects location selection.

- Development Approvals: Impact opening timelines.

- Signage Regulations: Influence branding strategies.

Compliance ensures smooth operations and regulatory adherence.

Choose Our Franchise Legal Services

Cloudhaus Law provides expert franchise legal services, offering:

- Proven Success: 80+ successful franchise openings across Ontario.

- Transparent Pricing: Flat-fee model for predictable costs.

- High Satisfaction: 4.9/5 rating from 35+ Google reviews.

- Local Expertise: Toronto-based with provincial reach.

- Comprehensive Services: FDD preparation, agreement negotiation, dispute resolution.

Contact Cloudhaus Law at (647) 965-0516 or cloudhauslaw.com for tailored guidance.

Frequently Asked Questions

What rights do franchisees have?

Complete disclosure, rescission rights, fair dealing, and association rights.

Are franchisors required to provide FDDs?

Yes, with detailed, accurate information delivered 14 days before agreements.

Can franchisees terminate for non-disclosure?

Yes, within two years for no FDD, or 60 days for incomplete disclosure.

How are disputes resolved?

Through negotiation, mediation, arbitration, or litigation, with mediation preferred.

What are shared responsibilities?

Good faith, fair dealing, and compliance with agreements for both parties.

How did 2020 amendments change the law?

Added refundable deposits, preliminary agreements, and financial statement flexibility.

What to look for in an FDD?

Financial stability, litigation history, fees, and territory rights for due diligence.

When to consult a franchise lawyer?

Early, for FDD review, agreement analysis, and dispute prevention.

Building Successful Franchise Relationships in Ontario

Ontario’s Arthur Wishart Act creates a balanced framework for franchise success, emphasizing:

- Transparency: Comprehensive disclosure ensures informed decisions.

- Fair Dealing: Good faith fosters trust and collaboration.

- Legal Protections: Rescission and other remedies safeguard investments.

- Modernization: 2020 amendments adapt to industry needs.

Franchisors benefit from clear compliance, building stronger systems through transparency and support. Franchisees achieve better outcomes with thorough due diligence and adherence to system standards. Professional legal guidance is critical, given the complexity and financial stakes. Early engagement with experienced franchise lawyers prevents costly mistakes and ensures compliance, fostering sustainable relationships.

Contact Cloudhaus Law at (647) 965-0516 or cloudhauslaw.com for expert support tailored to your franchise needs.