Franchising in Toronto’s vibrant market offers exciting opportunities for entrepreneurs. Yet, more than 20% of franchise disputes in Ontario stem from unclear contract terms. With industries ranging from retail to technology, franchise agreements must navigate complex legal requirements to protect investments. This article explores strategies to sidestep common mistakes in franchise agreements, empowering you to build a thriving business in Toronto’s competitive landscape.

Key Takeaways

- Key challenges in franchise agreements, such as misrepresentation and unclear terms

- Strategies to ensure compliance with Ontario’s franchise laws

- Innovative solutions, including Web3 technology, to protect your investment

- Real-world examples of successful franchise agreements in Toronto

Franchise Agreements in Toronto’s Market

Franchise agreements establish a clear partnership between franchisors and franchisees. In Toronto, a hub for food, retail, and tech industries, these contracts must follow Ontario’s Arthur Wishart Act (Franchise Disclosure), 2000. This law requires full transparency to protect both parties.

A strong agreement includes three main parts: the Franchise Disclosure Document (FDD), which shares financial and operational details; operational guidelines for daily tasks; and financial obligations, like royalty fees. These contracts also rely on four key elements: territorial rights to set market boundaries, intellectual property protections for brand assets, termination and renewal terms for flexibility, and dispute resolution processes to handle conflicts. For example, a Toronto coffee shop franchise needed clear territorial rights to avoid competing with another outlet just a block away.

To evaluate an agreement, check the franchisor’s financial health and ensure contract terms are clear. Confirm the franchise’s legitimacy in Canada by reviewing its registration with the Law Society of Ontario. Look for any lawsuits in the FDD. Choosing the right business structure matters too. A corporation offers liability protection, while a sole proprietorship suits smaller franchises.

The four principles of franchising, known as the 4 P’s, are product (the brand), process (systems), promotion (marketing), and people (training). These ensure consistency but can limit your control, like restricted marketing freedom, a common issue in Toronto franchises. Before signing, assess the franchisor’s track record and decision-making power. Franchisors often control branding and operations for uniformity, which can feel limiting. The average initial franchise fee in Canada ranges from $20,000 to $50,000. A letter of intent for a franchise helps you outline your commitment and negotiate terms early, setting a solid foundation.

For instance, a Toronto retail franchise we advised used a letter of intent to secure better royalty terms, saving $10,000 annually. This step ensures your goals align with the franchisor’s before you commit.

Frequent Challenges in Toronto Franchise Contracts

Franchise agreements can lead to legal or financial trouble if not carefully reviewed. Many franchises fail due to unrealistic expectations, legal non-compliance, or contract disputes. Below, we explore common issues and how to avoid them, with examples from Toronto’s franchise scene.

Misrepresentation Risks

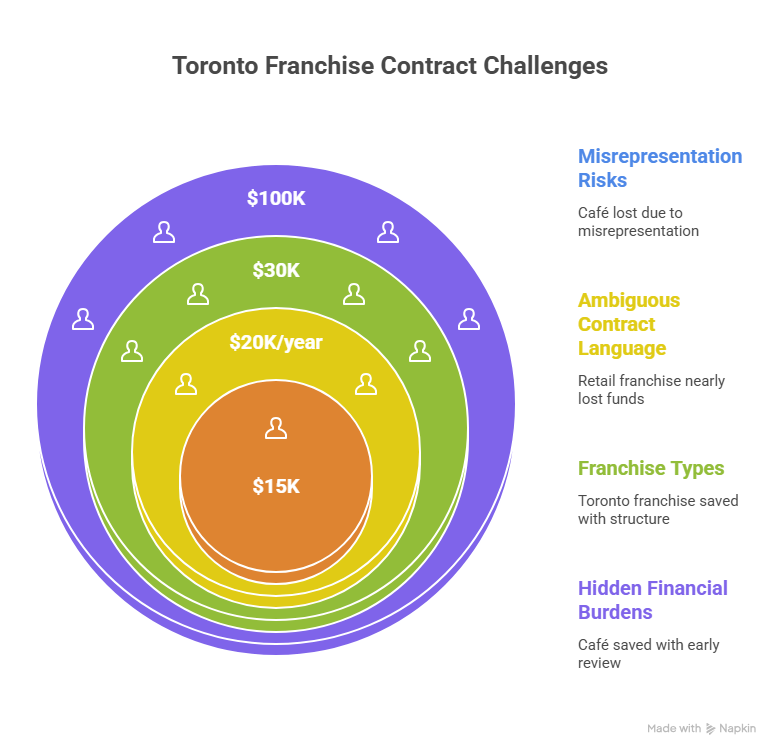

Misrepresentation happens when franchisors give false information, like exaggerated revenue projections. This is a major issue in Toronto’s competitive market. A local café franchisee found inflated sales figures in their FDD, nearly losing $100,000. To check if a franchise is legitimate in Canada, verify financial claims with independent data and review the franchisor’s litigation history.

A franchise agreement lawyer Toronto can ensure transparency, as required by the Arthur Wishart Act. For example, we caught misleading profit claims for a GTA bakery, protecting the franchisee’s investment.

Ambiguous Contract Language

Unclear clauses, especially for renewals or terminations, often spark Toronto franchise agreement disputes. A GTA retail franchisee faced sudden termination due to vague performance goals, pushing them to consider breaking the contract. In Ontario, you can terminate an agreement if the franchisor fails to disclose required information, but this may lead to lost investments or penalties.

To avoid this, ensure renewal terms list clear timelines and termination rights are specific. A Toronto franchise lawyer advice session helped a Toronto gym franchise clarify termination clauses, preventing a $30,000 dispute.

Disclosure Non-Compliance

The Arthur Wishart Act requires a 14-day disclosure period for the FDD, including financials and litigation history. Non-compliance can cancel an agreement or allow termination within two years.

A Toronto fitness franchise faced delays due to a missing litigation disclosure, stalling their launch. A franchise agreement review Toronto ensures compliance with Ontario franchise disclosure issues. We helped a GTA food franchise fix an incomplete FDD, saving weeks of delays.

Restrictive Non-Compete and Territory Clauses

Strict non-compete clauses or unclear territorial rights can block growth, a key drawback of owning a franchise. A Toronto tech franchisee was limited by vague territorial boundaries, halting expansion plans. Negotiate clear territorial definitions and fair non-compete terms with a franchise lawyer consultation Toronto. We secured broader territorial rights for a GTA retail chain, enabling two new locations.

Hidden Financial Burdens

Unclear financial terms, like royalty fees or hidden costs, can drain budgets. A GTA food franchisee found unexpected marketing fees, raising costs by 10%. Review all financial terms and compare them to Toronto’s industry standards. A Toronto franchise law firm can spot hidden costs. We saved a Toronto café $15,000 by identifying undisclosed fees early.

Franchise agreements come in four types: single-unit for one location, multi-unit for multiple sites, area development for regional control, and master franchising for sub-franchising. Each has unique risks, like higher costs for multi-unit setups. Structuring an agreement with clear terms reduces these risks. For example, we helped a Toronto multi-unit franchisee structure their agreement to cap royalty fees, saving $20,000 yearly.

Cloudhaus Law’s Strategies for Safe Franchising

Legal risks, like non-compliance or disputes, can threaten your franchise. Cloudhaus Law uses expertise and innovation to protect your investment, drawing on our success with over 70 GTA franchise locations and a 98% success rate in Web3 audits.

Thorough Contract Analysis

Clear contracts prevent common mistakes in franchise agreements. Our dual-qualified lawyer, Irbaz, licensed in Canada and the U.S., reviews every detail. We helped a Toronto retail franchise fix unclear renewal clauses, avoiding a $50,000 dispute. Agreements vary by type single-unit, multi-unit, area development, or master franchising each with distinct risks. Multi-unit deals, for instance, demand higher capital. W

e tailor terms to your franchise type and use a franchise agreement tips Ontario letter of intent to negotiate early, ensuring compliance. A Toronto spa franchise we advised saved $12,000 by negotiating lower fees upfront.

Rigorous Due Diligence

Due diligence guards against franchise contract pitfalls Toronto. We check franchisor financials, litigation history, and market fit to ensure a franchise suits your goals. For a GTA food franchise, we found undisclosed lawsuits, leading to better terms. We assess all franchise types to reduce liabilities of a franchise owner, like financial overreach. A Toronto tech franchisee avoided a risky deal after our due diligence revealed weak market demand, saving $75,000.

Effective Conflict Resolution

Disputes over territories or royalties often lead to contract breaches. We use mediation and arbitration to resolve issues quickly. For a Toronto fitness franchise, we settled a territorial dispute through mediation, saving $20,000. Clear dispute resolution clauses prevent escalation.

If you need to terminate an agreement, we assess grounds like non-compliance, minimizing penalties like lost investments. A GTA restaurant franchisee exited a contract cleanly after we proved FDD violations, avoiding a $40,000 loss.

Franchisees typically earn profits after paying royalty fees, often 5–10% of revenue. Unclear terms or disputes can cut earnings, showing why franchising is risky legally. Our strategies keep your franchise strong in Toronto’s market.

Common FAQs on Ontario Franchise Law

What to look out for in franchise agreements?

When reviewing a franchise agreement, watch for unclear terms, such as vague renewal or termination clauses, and ensure Ontario franchise law compliance under the Arthur Wishart Act. Check the Franchise Disclosure Document (FDD) for complete financials and litigation history.

What are the key disadvantages of a franchise agreement?

Franchise agreements can include high royalty fees, restrictive non-compete clauses, and rigid territorial rights, limiting your flexibility. In Toronto, unclear terms often lead to disputes, as seen in 20% of Ontario cases. Cloudhaus Law’s franchise agreement review in Toronto ensures balanced terms, minimizing financial and legal risks.

Can you negotiate franchise agreements in Canada?

Yes, franchise agreements in Canada are negotiable, particularly on territorial rights, fees, and renewal terms. In Toronto, negotiating clear clauses prevents Toronto franchise agreement disputes. We helped a GTA franchisee secure broader territorial rights, boosting their growth.

What two items are typically declined in a franchise agreement?

Franchisees often decline overly restrictive non-compete clauses and excessive royalty fees. In Toronto, vague non-compete terms can limit expansion, while high fees strain finances. Cloudhaus Law’s franchise lawyer consultation in Toronto helps renegotiate these terms for fairness, drawing on our success with 70+ GTA franchises to avoid franchise contract pitfalls in Toronto.

What makes a franchise fail legally or financially?

Franchises fail due to misrepresentation, non-compliance with the Arthur Wishart Act, or unclear financial obligations. In Toronto, incomplete financial disclosure or disputes over territory rights are common culprits.

How do you break a franchise agreement in Ontario?

Breaking a franchise agreement in Ontario requires proving non-compliance, such as an incomplete FDD under the Arthur Wishart Act, allowing rescission within two years. Alternatively, negotiate termination clauses or pursue mediation.

Why Choose Cloudhaus Law for Your Toronto Franchise

Franchise agreements in Toronto require careful navigation to avoid pitfalls like misrepresentation, unclear terms, and non-compliance. With over 70 GTA franchise locations opened, Cloudhaus Law offers unmatched expertise.

Our dual-qualified lawyer, Irbaz, brings Canada and U.S. knowledge, while our 98% Web3 audit success rate and $22.5M in utility token sales highlight our innovative approach. We help franchisees and franchisors ensure compliance and protect investments. Book a Consultation with Cloudhaus Law to secure your franchise’s success in Toronto.