As a business owner in Canada, understanding Canadian securities laws is essential for compliance and fostering trust with investors. These laws, overseen by securities regulators, govern the issuance and trading of securities, ensuring fair treatment for businesses and investors. This blog provides guidance on navigating these regulations to avoid legal pitfalls and support your business’s financial strategy.

1. Understanding Canadian Securities Laws

Canadian securities laws protect investors and maintain financial market integrity, regulating how public companies and private issuers issue and trade securities. While there’s no single national regulator, provincial securities commissions, coordinated by the Canadian Securities Administrators (CSA), enforce regulations. The CSA harmonizes provincial securities laws, though regulatory authorities may impose province-specific requirements.

2. When Do Canadian Securities Laws Apply to Your Business?

Securities laws apply when your business issues or trades securities, regardless of whether it’s a public company or a startup. Key scenarios include:

- Issuing Securities: Raising funds through shares or bonds triggers compliance with disclosure and investor protection rules.

- Private Placements: Raising capital from accredited investors via private placements requires adherence to exemptions and offering memorandum rules.

- Public Offerings: Going public involves extensive disclosure, including annual reports and financial statements.

Example: A tech startup in Ontario selling shares to investors must comply with the Ontario Securities Commission’s rules under the Ontario Securities Act.

3. Key Components of Canadian Securities Laws

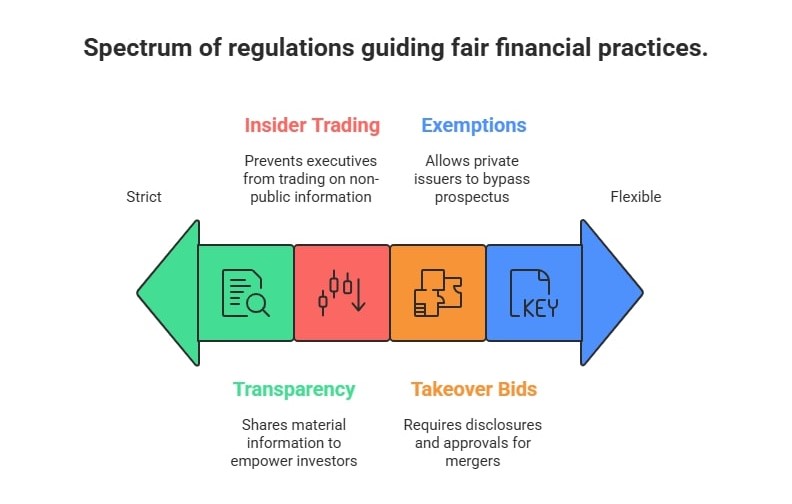

Understanding these components ensures compliance:

- Disclosure Requirements: Businesses must provide material information, like financial statements and risks, in prospectuses or annual information forms, enabling informed investor decisions.

- Insider Trading: Insider trading laws prohibit executives or senior officers from trading based on non-public information, upholding fiduciary duty to investors.

- Takeover Bids: Mergers or acquisitions require disclosures and approvals from regulatory authorities for transparency.

- Exemptions: Private issuers may use exemptions for private placements, avoiding prospectus requirements if conditions are met.

4. Navigating the Prospectus Requirement

A prospectus is a critical offering document for public securities offerings, detailing the company’s operations, financials, and risks.

- What is a Prospectus?: A comprehensive document for investors, reviewed by securities regulators before public offerings like IPOs.

- When Required?: Mandatory for public offerings, filed with provincial regulators.

- Exemptions: Private placements may bypass prospectuses using exemptions, such as those for accredited investors, with an offering memorandum.

Example: A company listing on the Toronto Stock Exchange (TSX) must file a prospectus with the Ontario Securities Commission.

5. Compliance with Continuous Disclosure Requirements

Public companies face continuous disclosure requirements to keep investors informed:

- Quarterly and Annual Reports: Include financial statements, like income and cash flow statements, for transparency.

- Material Changes: Disclose significant events, such as major contracts, via news releases to avoid selective disclosure.

- Management Discussion and Analysis (MD&A): Analyzes financial performance and risks, offering insights to security holders.

6. Seeking Legal Guidance for Securities Compliance

Navigating securities laws is complex, requiring professional guidance. At Cloudhaus Law, our legal team helps business owners comply with provincial securities laws, prepare disclosures, and structure capital raises. Regular consultations with legal professionals ensure compliance with evolving regulations and minimize legal risks.

Tip: Engage legal counsel to review offering documents and ensure adherence to CSA standards.

Conclusion

Canadian securities laws, enforced by securities regulators, are vital for business owners issuing securities or raising capital. By understanding disclosure obligations, insider trading rules, and prospectus requirements, you can ensure regulatory compliance and protect investors. Whether pursuing private placements or public offerings, Cloudhaus Law offers tailored legal services to navigate the securities landscape, safeguarding your business and its stakeholders. Contact us for expert advice on securities compliance.