Choosing the right type of corporation is a critical step for business owners in Canada, as it determines how your business operates, scales, and complies with national or provincial laws. Whether you’re exploring federal business incorporation in Canada or planning a provincial incorporation, the decision influences your legal structure, name protection, and growth opportunities.

This article explores the difference between federal and provincial incorporation, the types of corporations in Canada, and how to decide between the two based on your business goals. To learn more, check out our detailed guide Federal vs. Provincial – Which One is Right for Your Business?.

Federal vs Provincial Incorporation in Canada: Key Differences

When deciding whether to incorporate federally or provincially, it’s important to understand how each jurisdiction affects your rights, obligations, and business reach.

-

Federal incorporation is governed by the Canada Business Corporations Act (CBCA) and managed by Corporations Canada. It allows businesses to operate under one registration across all provinces and territories, offering nationwide name protection.

-

Provincial incorporation, by contrast, is governed by laws like the Ontario Business Corporations Act or British Columbia Business Corporations Act. It primarily limits your operations to that specific province, though expansion is possible through extra-provincial registration.

Entrepreneurs often compare federal vs provincial incorporation pros and cons to identify which aligns best with their structure and future plans.

Federal Corporations

Federal business incorporation in Canada falls under the Canada Business Corporations Act (CBCA), providing a unified legal framework that applies across the country. Businesses incorporated federally enjoy nationwide name protection and greater flexibility to operate or expand across multiple provinces and territories.

Types of Federal Corporations:

- Private Corporations

Private corporations are owned by a small group, such as business partners or family members, with restricted share transfer flexibility to maintain control within the group. They offer limited liability protection for shareholders.

Example: A family-owned software firm operating nationwide as a Canadian-controlled private corporation, using federal incorporation to expand efficiently. - Public Corporations

Public corporations issue shares to the public via stock markets, adhering to strict regulatory requirements for financial reporting, shareholder rights, and governance under the CBCA.

Example: A telecommunications company publicly traded on the Toronto Stock Exchange (TSE), with operations spanning multiple provinces under federal company incorporation in Canada. - Non-Profit Corporations

Non-profit corporations focus on social, charitable, or educational purposes, governed by the Canada Not-for-profit Corporations Act (CNCA), with no profit distribution to members

Example: A national charity that provides education programs to underserved communities across Canada through federal business incorporation.

Provincial Corporations

Provincial incorporation in Canada allows businesses to register under provincial legislation such as the Ontario Business Corporations Act or British Columbia Business Corporations Act. These corporations primarily operate within their province but can expand through extra-provincial registration.

If you are based in Ontario, you may specifically consider provincial incorporation Ontario under Ontario’s business laws, which offer flexibility for local businesses while maintaining limited liability protections.

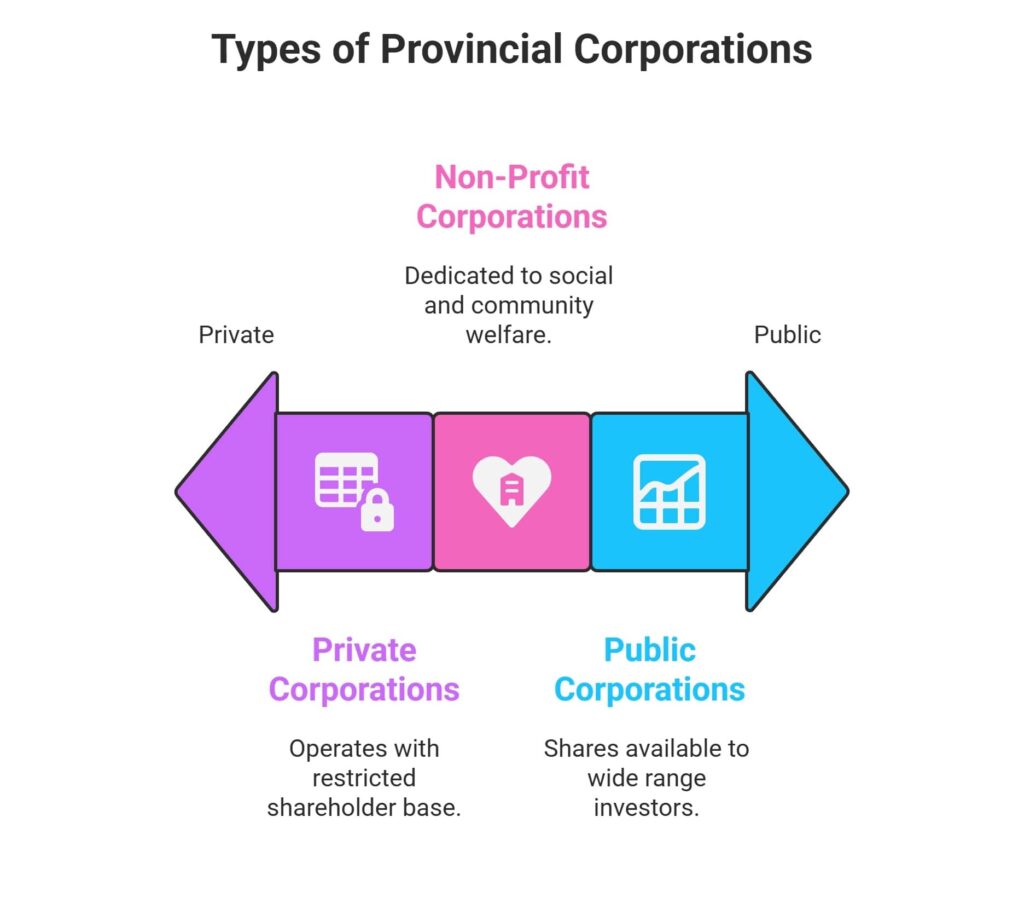

Types of Provincial Corporations:

- Private Corporations

Provincial private corporations are owned by a small number of individuals, typically local business owners or partners, who keep ownership within a restricted circle.

Example: A restaurant chain in British Columbia operating under provincial incorporation and catering to local customers. - Public Corporations

Provincial public corporations issue shares to the public but are regulated by provincial securities commissions.

Example: An Alberta-based energy company operating under provincial incorporation laws, focusing on provincial markets. - Non-Profit Corporations

Provincial non-profit corporations focus on social, community, or charitable objectives within the province.

Example: A Quebec organization providing food programs under provincial incorporation laws. - Unlimited Liability Corporations (ULCs)

Some provinces, like Alberta and Nova Scotia, offer Unlimited Liability Corporations (ULCs) which provide certain tax advantages but expose shareholders to personal liability for business debts.

Example: A Nova Scotia real estate investment firm structured as a ULC, leveraging tax benefits while accepting personal liability.

Which Type of Incorporation Is Right for You?

The federal vs provincial incorporation choice depends on your long-term business strategy, budget, and expansion plans.

Choose federal business incorporation Canada if you plan to expand across provinces, need nationwide name protection, or want a uniform legal framework.

Choose provincial incorporation if your business is local, such as operating primarily in Ontario, Alberta, or Quebec, with no immediate plans for nationwide growth.

If you ever decide to expand beyond your province, you can register your existing company in another province, commonly referred to as moving a corporation to another province, through extra-provincial registration.

Conclusion

Canada’s incorporation framework offers flexibility to match your business goals. Federal incorporation is ideal for entrepreneurs aiming to grow beyond provincial borders, benefiting from national name protection and uniform governance. Provincial incorporation, on the other hand, is simpler and better suited for localized businesses.

Understanding the jurisdiction of incorporation, whether federal or provincial incorporation, ensures your company operates legally and efficiently across Canada. For many, consulting a legal expert helps weigh the federal vs provincial incorporation pros and cons effectively.

Frequently Asked Questions

What types of corporations are available under federal law?

Federal corporations include private corporations, public corporations, and non-profit corporations, all capable of operating across Canada with federal name protection.

What types of corporations are available under provincial law?

Provincial corporations include private corporations, public corporations, non-profit corporations, and Unlimited Liability Corporations (ULCs), particularly in provinces like Alberta and Nova Scotia.

What is an Unlimited Liability Corporation (ULC)?

A ULC is a provincial corporation where shareholders face personal liability for business debts, often used for tax advantages in Alberta or Nova Scotia.

Can a federal corporation operate only within a single province?

Yes. Even though federal corporations can operate nationwide, they can choose to focus on a single province. The benefit is they won’t need new registration if they later expand across provinces.

Still unsure about the right corporation for your business?

At Cloudhaus Law, our experienced corporate lawyers help entrepreneurs and business owners understand federal incorporation vs provincial incorporation in detail. Whether you’re forming a startup in Ontario or expanding your business across Canada, we provide tailored legal advice on choosing between federal business incorporation and provincial incorporation.

Our experienced corporate lawyers guide business owners through the incorporation process, ensuring a corporate structure that supports your growth plans. Whether starting small or aiming for nationwide expansion, we offer tailored business advice. Here is a detailed guide on key documents for starting a corporation. Contact us today for a free consultation to incorporate your business with confidence!